STORIES OF IMPACT

/

Articles by Endurance / New Proposed Capital Rule By Steven Patrick

New Proposed Capital Rule By Steven Patrick

The long-awaited new proposed capital rule has finally arrived, spanning well over a thousand pages and addressing precisely the anticipated points. This development has been long in the making, and many might express a collective "finally" in response. Approximately three decades ago, Value at Risk (VaR) established itself as a fundamental concept in financial risk analytics. Now, it's finding its place within bank capital regulations, a significant stride forward. However, it's important to note that this new regulation won't have a universal impact; it will initially apply primarily to the largest few dozen banks.

Moreover, it's worth emphasizing that while the analysis of market risk through VaR is crucial, it's just one facet of the diverse risks that capital must safeguard against. This freshly introduced rule not only refines the treatment of credit risk but also introduces a novel assessment of operational risk.

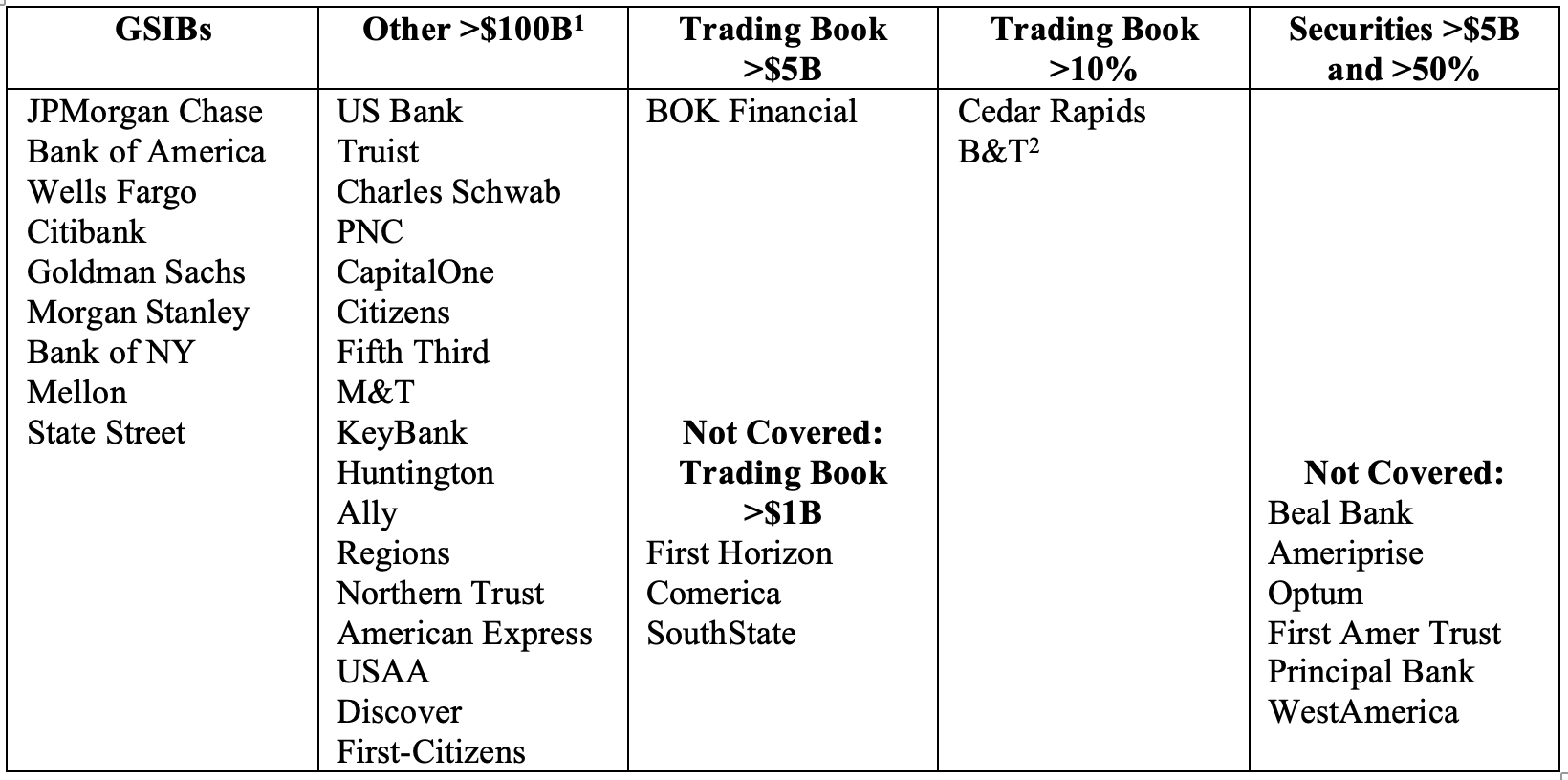

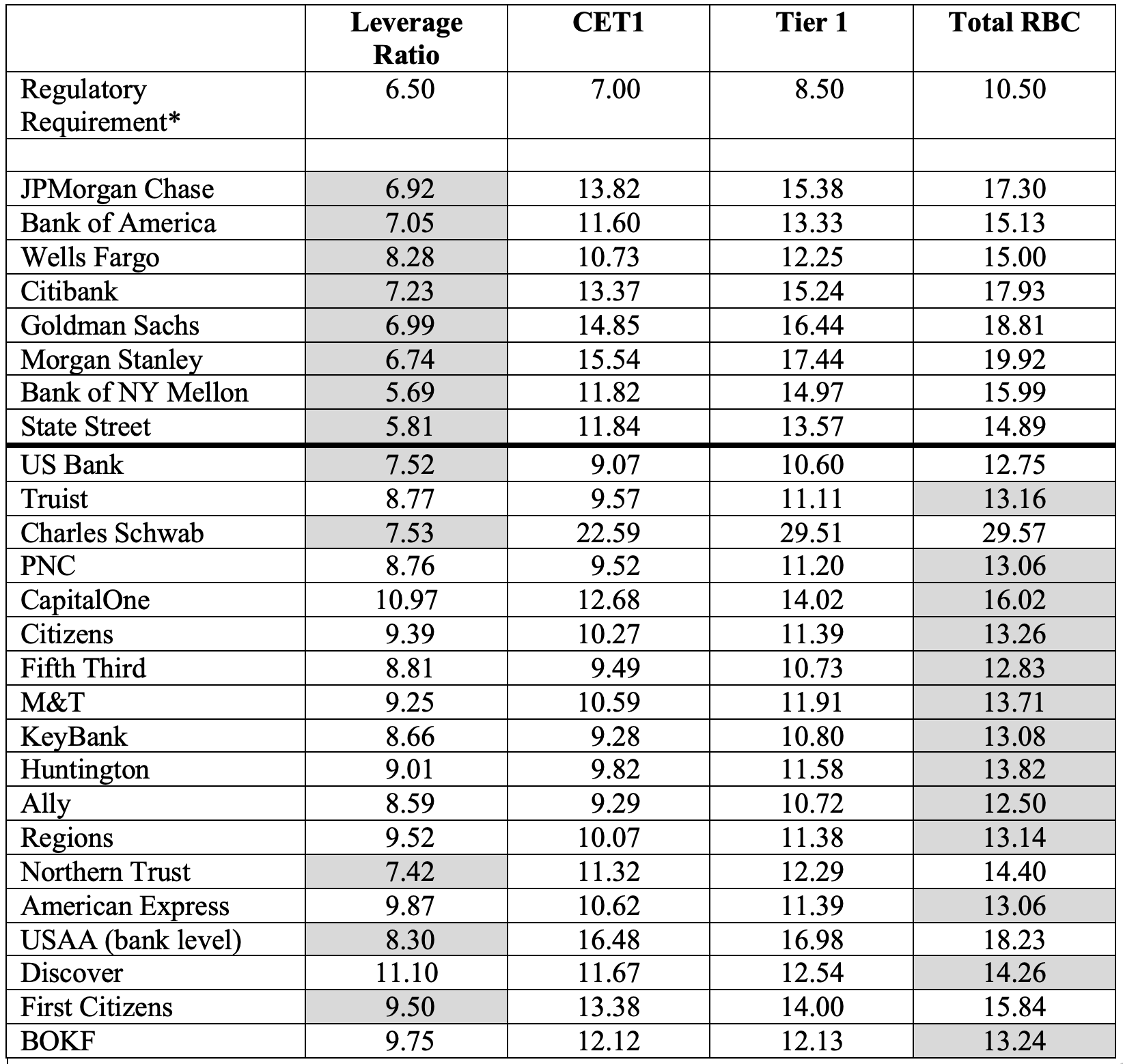

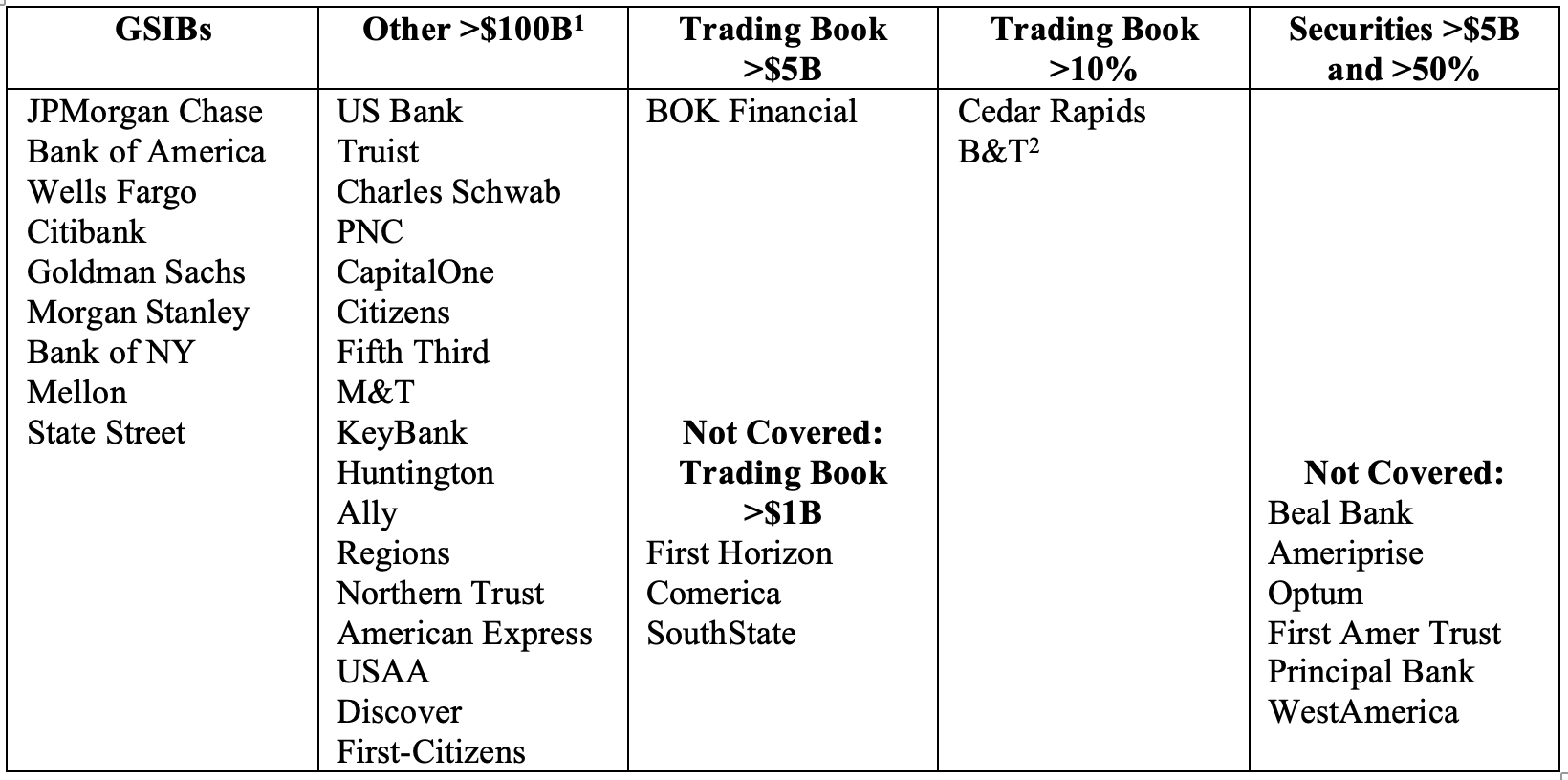

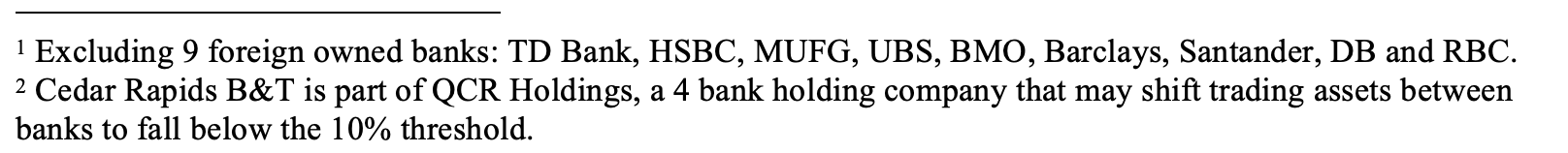

Scope and Applicability The rule's scope ostensibly encompasses exclusively the largest banks (those with assets exceeding $100 billion, falling within regulatory categories I-IV). Additionally, smaller institutions engaged in substantial trading activities (with trading assets surpassing $5 billion or constituting over 10% of their total assets, up from the previous threshold of $1 billion) will also be subject to this rule. There's even the possibility of future amendments to include entities with substantial securities portfolios. Notably, the rule targets specific banks, as evidenced by the data from the balance sheets as of December 2022, detailed in the table below.

Potential Impacts on Additional Banks Apart from the primary focus on larger banks, it's worth considering the potential ripple effect on institutions boasting substantial securities portfolios. These entities, with securities exceeding $5 billion and comprising over half of their total assets, might find themselves drawn into the ambit of this new rule.

The 8 GSIBs were already subject to many elements of this new capital rule, so the brunt of the impact will be on the 17 category III and IV banks in the Other >$100B column as well as the 1 with trading exposure (currently only BOKF). As currently proposed, only these 26 banking organizations would be impacted by the new rule, and only 18 of them would face a material change. That said, “impact” is relative; all of these banks already perform extensive stress testing.

Defining Capital and Its Components

The introduction of the new proposed capital rule brings about significant changes, particularly in the context of holding companies' capital. This rule extends its reach beyond just the capital requirements for bank subsidiaries. In essence, it impacts large banking organizations encompassing both the holding company and its subsidiary banks. As a result, the practice of double leverage – utilizing subordinated debt or trust preferred at the holding company to fund common equity in subsidiary banks – sees limited regulatory advantages.

The primary forms of capital for banking organizations include common equity tangible capital (CET1) or common equity minus intangible assets. This is an essential aspect, with the majority of capital being directed towards this. Additional tiers of capital include perpetual preferred stock for Tier 1 and various elements like fixed maturity preferred, trust preferreds, subordinated debt, and the allowance for loan losses for Tier 2 capital.

Addressing Other Factors: Intangibles, AOCI, and Risk Weighting

While the rule accounts for several line items, certain adjustments are rarely impactful. For instance, mortgage servicing rights or deferred tax assets beyond 10% of common equity are treated as intangibles that reduce capital. However, these adjustments seldom come into play given the nature of impacted banking organizations. On the Tier 2 side, limitations exist for the usage of the allowance for loan losses (ALLL), though these constraints don't significantly affect most institutions.

One intriguing aspect pertains to the valuation adjustment for available-for-sale securities within common equity, termed "accumulated other comprehensive income" (AOCI). Most banks choose to exclude AOCI, both gains and losses, from their common equity. This decision stems from the understanding that the discount/premium will be realized over time through earnings. Moreover, the rule avoids delving into this issue by relying on accounting figures, eliminating the option to exclude AOCI. Notably, the rule does not address mark-to-market adjustments on other financial assets or liabilities like held-to-maturity securities, loans or deposits.

Understanding Risk Weighted Assets (RWA)

The proposed rule introduces a comprehensive perspective on risk weighted assets (RWA). It combines three core risk categories – credit, operations, and market risk – along with a provision for credit valuation adjustments on derivatives (CVA). This method, previously limited to Global Systemically Important Banks (GSIBs), now extends to a broader range of institutions. This shift from the conventional standardized approach represents a substantial improvement.

Credit risk under the new rule is a more complicated version of the risk buckets currently used for RWA calculations. For example, Government-Sponsored Enterprise (GSE) exposures are still in the 20% bucket, but a new 40% bucket was created for most inter-bank exposures. Complex bucketing systems, based on factors such as cash flow and loan-to-value, dictate the placement of residential real estate and commercial real estate (CRE) exposures. Notably, regulators did not use this opportunity to shift risk capital to the industry standard probability of default times loss given default approach.

Operations risk, evaluated at 12.5 times the operational risk capital component, focuses on indicators like net interest margin (NIM), fee income, and trading revenue, alongside an internal loss multiplier. The intention is to capture the risk arising from earnings volatility due to internal control or operational breakdowns.

Market risk assessment, detailed extensively in the rule, primarily relies on Value at Risk (VaR) analysis, primarily concerning interest rate fluctuations. The rule dedicates over 200 pages to this topic, underscoring its complexity.

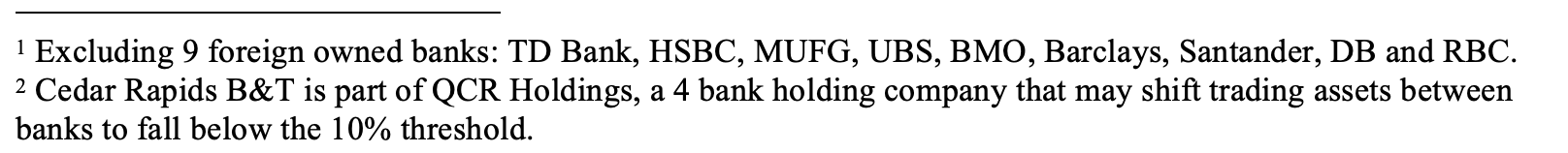

Understanding Ratios and Their Implications

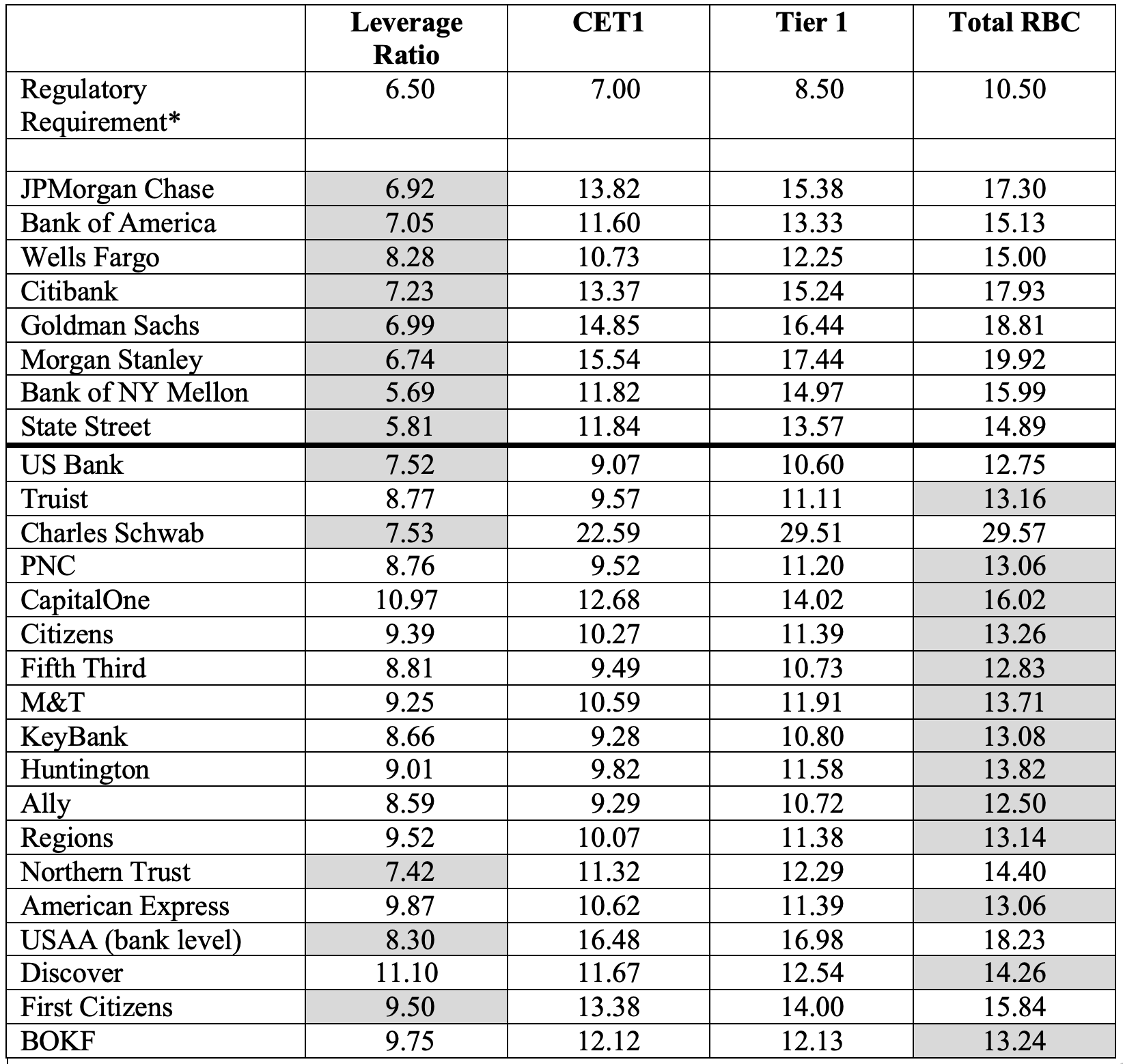

The proposed rule introduces a fresh approach to calculating risk-based capital ratios, integrating a variety of ratios including common equity tier 1 (CET1), tier 1, and total risk-based capital ratios. This system also accounts for supplemental capital ratios and the capital conservation buffer. This integrated approach will harmonize with the existing leverage ratio and other safety and soundness regulations. However, for many affected banks, the leverage ratio remains the more stringent constraint, thus potentially diminishing the direct impact of the new rule. A table illustrating the capital ratios of the 26 covered banking organizations under current rules (not the proposed rule) relative to regulatory requirements is presented below. Since the GSIBs already follow a similar methodology, their results provide a leading indicator of the likely impact on the other big banks.

Impact

Banks consistently need to identify their most vulnerable capital ratio, the "weak link." In the table provided above, the weak link for each bank is highlighted. Notably, among all the Global Systemically Important Banks (GSIBs), the leverage ratio stands out as the primary concern, frequently exhibiting a substantial gap (roughly 40%) to the next tightest capital ratio. Consequently, alterations to Risk-Weighted Assets (RWA) hold limited significance, as long as they remain within the 40% threshold. This pattern suggests that changes in RWA, as long as they stay below this margin, won’t have any impact.

For the remaining significant banks, the leverage ratio and total risk-based capital ratio generally remain closely aligned. Following the trajectory of GSIBs, it's probable that the new rule will lead to a reduction in RWA, ultimately making the leverage ratio the focal point. Ironically, given the new rule's selection of the higher value between the new RWA calculation and the calculation from the current “standardized” RWA approach, numerous banks (including GSIBs) could revert back to standardized RWA calculations, rendering the new rule inconsequential.

In situations where a notable shift occurs and capital becomes constrained, bankers will need to navigate their weak link. This might involve raising capital, adjusting dividend policies, or more commonly, controlling the bank's asset expansion. In scenarios where RWA emerges as a concern, segments with elevated RWA might witness contraction. The crux of the matter revolves around assessing the return on the capital necessary to maintain those assets.

For Smaller Banks The central impact primarily revolves around a significant shift in risk management best practices. Although these methodologies and the accompanying stress testing might not be mandated by regulations, they will inevitably become standard practice to align with the expectations set by bank examiners.

This presentation is being furnished on a confidential basis to provide preliminary summary information. The information, tools and material (collectively, information) contained herein is not directed to or intended for distribution or use by any person or entity who is a citizen or resident of or located in any jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would subject Endurance Advisory Partners, LLC, to any registration or licensing requirement within such jurisdiction.

The information presented herein is provided for informational purposes only and is not to be used or considered as an offer to sell, or buy securities or other financial instruments, or any advice or recommendation with respect to such securities or other financial instruments. The information may not be reproduced in whole or in part or otherwise made available without the prior written consent of Endurance Advisory Partners, LLC. Information and opinions presented have been obtained or derived from sources believed to be reliable, but Endurance Advisory Partners, LLC makes no representation as to their accuracy or completeness. Endurance Advisory Partners, LLC, accepts no liability for any loss arising from the use of the information contained herein.

This information is subject to periodic update and revision. Materials should only be considered current as of the date of the initial publication, without regard to the date on which you may access the information. Endurance Advisory Partners, LLC, maintains the right to delete or modify the information without prior notice.

Under no circumstances and under no theory of law, tort, contract, strict liability or otherwise, shall Endurance Advisory Partners, LLC be liable to anyone for any damages resulting from access or use of, or inability to access or use, this information regardless of whether they are dire, indirect, special, incidental, or consequential damages of any character, including damages for trading losses or lost profits, or for any claim or demand by any third party, even if Endurance Advisory Partners, LLC knew or had reason to know of the possibility of such damages, claim or demand.