STORIES OF IMPACT

/

Articles by Endurance / Introducing The New CRA Framework

Introducing the New CRA Framework by Steven Patrick

Banking regulators have finally released the long-awaited final rule reforming Community Reinvestment Act (CRA) regulations—a regulation that often receives mixed sentiments from bankers. Fortunately (or unfortunately), regulatory changes typically unfold incrementally. The new rules, therefore, build upon existing ones rather than taking a wholly new direction.

CRA regulation mandates that banks extend loans to low- and moderate-income borrowers or those in low- to moderate-income census tracts. One historical frustration stems from the lack of specific metrics outlining the required number or dollar amount of such lending. The performance under CRA is contingent on various factors:

• Type of exam: Typically size-based (small, intermediate, large) or for limited purpose/wholesale banks.

• Assessment Area

• Low-Mod lending: (<80% of area median income) in the assessment area

• Investment and services performance

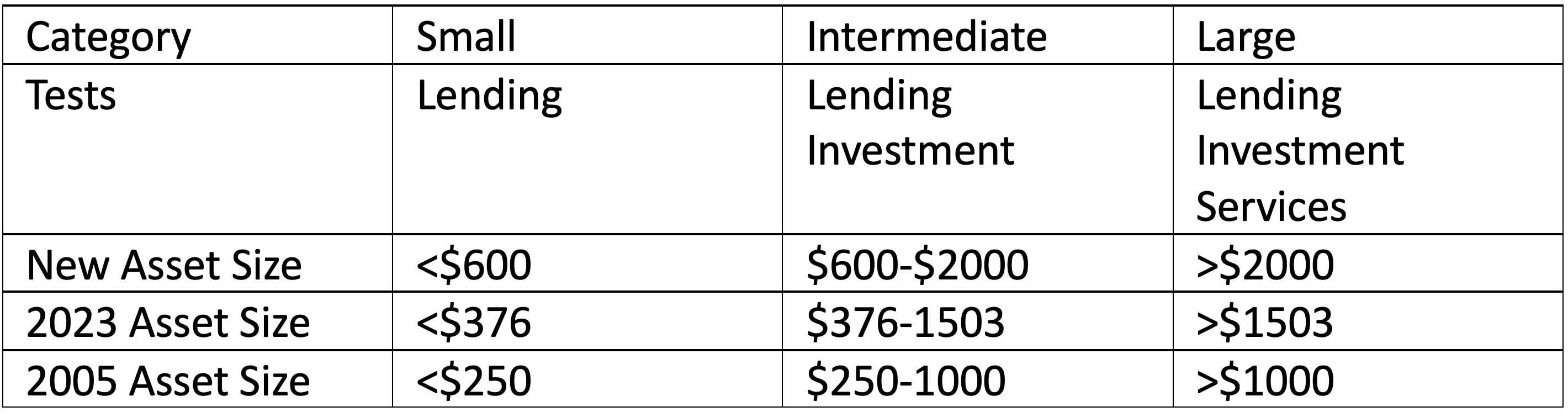

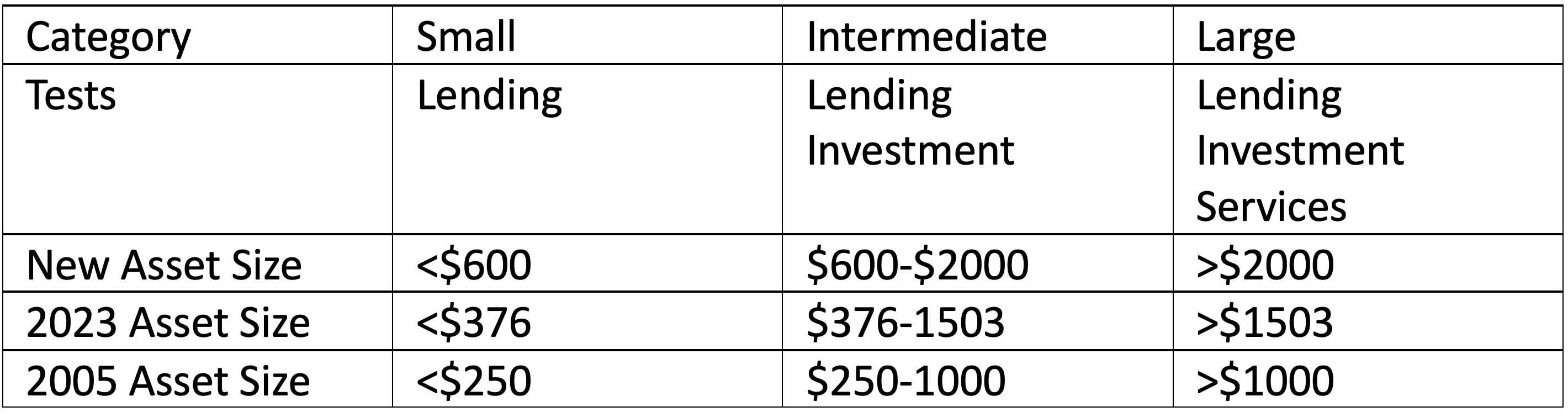

CRA exams range from simplified lending exams for small banks to a combination of lending, investment, and services tests for large banks. The size thresholds for these categories have evolved over time. The new CRA regulation, however, raises these thresholds even further, enabling more banks to qualify as small or intermediate, thereby streamlining the examination process for more banks.

The new size ranges relative to the old ones are shown in the table below:

The initial step in a CRA exam involves determining the bank’s assessment area. The old regulations relied on a “facility-based assessment area” (FBAA), meaning it depended on the locations of the bank's physical branches. However, this posed challenges as banking shifted to digital platforms where customers open accounts online or via mobile apps. The new CRA regulation mandates large banks to evaluate performance in retail lending assessment areas (RLAA), MSAs where they made at least 150 mortgage loans or 400 small business loans annually for the past two years. Small and intermediate banks typically use FBAAs but may opt for RLAAs. Notably, the new rule explicitly covers lending in “outside retail lending areas”—all metro areas not in a bank’s FBAA or RLAA.

Once the assessment area is specified, each bank conducts a lending test. The old regulations began by comparing the bank’s Loan/Deposit ratio and loans inside its assessment area relative to total loans. If either was too low, including <50% in its AA, it resulted in an unsatisfactory CRA rating. The new evaluation of outside retail lending areas should render the “majority in its AA” requirement obsolete, thus avoiding an automatic unsatisfactory rating.

The next step was evaluating community lending by comparing loans inside its AA in Low-Mod census tracts/Total, mortgage loans inside its AA to Low-Mod income borrower/Total, and loans inside AA to Low-Mod revenue business/Total. The new CRA rule covers three loan categories: residential mortgages, small business loans, and small farm loans.

The Community Development investment test (for intermediate and large banks) evaluates qualifying investments relative to total assets. The mortgage-backed securities and SBA securities markets respond to CRA requirements by creating pools that are CRA eligible. Such pools trade at a premium and are often purchased by banks to improve their CRA score, then sold to other banks for repeated use.

Large banks have an additional category for CRA performance evaluation—services. Banks typically track service hours performed by staff in the community.

Under the old CRA rules, large banks could earn up to 12 points for lending and up to 6 points each for investment and services (a total of 24 possible points) with a 50:25:25 weighting. The new CRA rules shift the weighting to 40% lending plus 10% lending services and 40% investment plus 10% community development services. Small banks continue to be evaluated solely on lending (100% weight), and intermediate-sized banks are now 50:50, lending and investment.

Ratings are subjective and somewhat circular: “outstanding” when a bank is “excellent” on various measures, “high satisfactory” when “good,” “low satisfactory” when “adequate,” “needs to improve” when “poor,” and “substantial noncompliance” when “very poor.” For the lending test, seven metrics are used, but since target levels for each metric are not defined and may vary bank-to-bank, the test is somewhat subjective.

Under the old regulation, one key question was what small and intermediate-sized banks could do if >50% of their loans come from outside their FBAA. Any bank that originated more than half of its loans outside its FBAA would automatically be graded unsatisfactory. To avoid this, such banks needed to develop a CRA strategic plan. The new regulation includes the same CRA strategic plan process, but fewer banks are expected to take this route because the evaluation of “outside retail lending areas” enables banks to show their aggregate CRA performance. Nonetheless, the key benefit to taking the CRA strategic plan route is that the test becomes objective; the plan will specify the metrics used as well as performance level needed to achieve each score.

Endurance Advisory Partners is able to assist banks in CRA compliance, especially in making the decision to target specific lending and investment activities or develop a strategic plan to submit for approval.

Endurance Advisory has evaluated the CRA strategic plans and performance thereon (not surprisingly, banks receive “outstanding” scores more often when they write the test) for numerous digital banks and mortgage-centric banks:

Digital Banks

• Ally Bank (outstanding)

• American Challenger (not assessed)

• Celtic Bank (satisfactory)

• First Internet Bank (satisfactory)

• Green Dot Bank (outstanding)

• Live Oak Bank (outstanding)

• Medallion Bank (outstanding)

• SoFi Bank (not assessed)

• The Bancorp Bank (outstanding)

• WebBank (outstanding)

Mortgage-Centric Banks

• Bank of England (satisfactory)

• Northpointe Bank (needs to improve)

• USAA Bank (large, needs to improve)

This presentation is being furnished on a confidential basis to provide preliminary summary information. The information, tools and material (collectively, information) contained herein is not directed to or intended for distribution or use by any person or entity who is a citizen or resident of or located in any jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would subject Endurance Advisory Partners, LLC, to any registration or licensing requirement within such jurisdiction.

The information presented herein is provided for informational purposes only and is not to be used or considered as an offer to sell, or buy securities or other financial instruments, or any advice or recommendation with respect to such securities or other financial instruments. The information may not be reproduced in whole or in part or otherwise made available without the prior written consent of Endurance Advisory Partners, LLC. Information and opinions presented have been obtained or derived from sources believed to be reliable, but Endurance Advisory Partners, LLC makes no representation as to their accuracy or completeness. Endurance Advisory Partners, LLC, accepts no liability for any loss arising from the use of the information contained herein.

This information is subject to periodic update and revision. Materials should only be considered current as of the date of the initial publication, without regard to the date on which you may access the information. Endurance Advisory Partners, LLC, maintains the right to delete or modify the information without prior notice.

Under no circumstances and under no theory of law, tort, contract, strict liability or otherwise, shall Endurance Advisory Partners, LLC be liable to anyone for any damages resulting from access or use of, or inability to access or use, this information regardless of whether they are dire, indirect, special, incidental, or consequential damages of any character, including damages for trading losses or lost profits, or for any claim or demand by any third party, even if Endurance Advisory Partners, LLC knew or had reason to know of the possibility of such damages, claim or demand.