STORIES OF IMPACT

/

White Papers / Important Synergies And Complexities For Non-bank Conversions To A Bank

Important Synergies And Complexities For Non-bank Conversions To A Bank

Executive Summary

Many non-banks consider acquiring a bank (or establishing a de novo bank) to serve their customers and, frankly, capture various benefits afforded to a bank. Before embarking on this strategy, it is critical to determine the order of magnitude of the benefits as well as the costs of operating in the tightly controlled bank environment.

Endurance Advisory has identified three key benefits for non-banks.

- Lower borrowing cost

- Savings on payment processing fees

- Benefiting from low-cost deposits

On the cost side, myriad regulations, administrative burdens, and compliance requirements must be considered.

Non-banks may buy a bank to capture the value of providing financial services directly. For example, a non-bank that can transfer loan receivables to a bank (e.g., the loan pipeline of a mortgage bank or loans made by a non-bank finance company) benefits from lower borrowing costs. Payments business – wires, ACH, debit card, credit card – flow through banks, so all of those fees remain in the new bank. Finally, deposits are valuable, and the new bank’s franchise value rises to the extent that the company controls deposits. These three areas of potential benefits must be weighed against the costs of operating as a bank.

SoFi acquires community bank Golden Pacific Bancorp to speed up its national bank charter process

Borrowing Cost

Borrowing costs for non-bank finance companies are usually far higher than bank costs. Non-bank finance companies are never on a level playing field relative to their bank competitors. And, since interest expense is like their cost of goods sold, borrowing costs really matter. As a result, non-bank finance companies are often only successful with products or customers that banks don’t serve. Alternatively, non-banks may follow an originate-to-distribute model where loans or other assets aren’t held to maturity, so the borrowing cost disadvantage is less important.

Examples of non-bank assets include both consumer and commercial customers. Consumer finance companies do personal installment loans or serve non-prime customers (or both). Commercial finance companies do factoring, mezzanine debt, leasing or other products or otherwise serve clients that don’t fit inside the normal bank loan box.

Meanwhile, banks face CRA pressure to “bank the under-banked.” In some cases, it makes sense to combine non-bank and bank portfolios, primarily to lower the non-bank’s borrowing cost but also to serve underserved communities. For example, in place of a payday loan, a bank can offer overdraft protection for a fee that achieves similar economics. Overdraft protection and/or NSF fees, after all, are often a big part of bank fee income. It is critical to recognize that the Community Reinvestment Act encourages banks to actively lend in their communities so that their portfolio reflects the entire community – especially the marginalized segments.

Mortgage banks in particular can dramatically lower borrowing cost and, hence, boost profitability as a bank. A typical mortgage bank finances its pipeline of loans closed with borrowers but not yet sold to investors at a rate of L + 2-3%. The same loans, when pledged as collateral to the FHLB, can be financed at LIBOR flat. Assuming a 30 day hold period, that amounts to a 20 bps increase in profit margin. That’s a lot considering that the average margin is normally about 40 bps. A couple of years ago, Gateway Mortgage won approval to acquire a bank and become Gateway First Bank.

In the fintech space, “lenders” originate-to-distribute to minimize their cost of borrowing. Lenders like OnDeck, Kabbage, LendingClub and LendingTree serve as intermediaries, connecting borrowers with lenders (typically banks, investors or, in the case of LendingClub, providing a peer-to-peer network). SoFi recently won approval to buy a bank and announced a deal for a small California bank.

Obviously, there is no free lunch; banks come with tighter regulation. Moving non-bank activities into a bank requires a carefully constructed business plan which examines the loss history of the new asset type as well as scenario-based stress testing. In the right situation, borrowing cost savings alone can make it worthwhile.

Payments / Transaction Processing

Non-Bank lenders can save by running transactions through their own bank. Mortgage banks, for example, wire funds to the title company or closing agent who, in turn, wires funds to pay off any existing mortgage and wires the rest to the seller. As a bank providing title services, the company can avoid all three wire fees. (In fact, wire fees alone can make it profitable for a title company to buy a bank.) Then, when servicing the mortgages, fees for card payments or setting up transfers are kept by the bank.

Consumer finance companies can capture ATM fees and debit card interchange revenue. Banks earn fees with every swipe of a consumer’s card. To the extent that consumer finance non-banks can direct this traffic in-house as a bank, it can capture this revenue stream.

Fintech companies are disintermediating both bank and finance company service offerings. In fact, some fintechs are obtaining bank charters or pursuing partnership/vendor agreements that amount to “rent-a-bank” transactions. Moreover, considering the technology spend at big banks, one could argue that they operate captive fintech companies. For the most part, fintech companies are better positioned to manage transaction volume rather than hold assets on a balance sheet, so when fintech’s pursue a bank charter, it’s usually about controlling the payments process.

Getting Paid for Deposits

Mortgage Servicers control escrow deposits, which are core deposits. Escrows vary state-by-state but can average as much as 1% of the principal balance of mortgages serviced. Bringing these balances in-house increases non-interest-bearing deposits and can dramatically increase the franchise value of a bank.

Consumer finance customers hold one type of deposit – prepaid card balances. Bankers don’t normally think of sub-prime consumers as deposit customers because they have low savings balances. That said, these customers often use prepaid cards to meet their needs. Every time a card is loaded, those funds become a deposit somewhere. Controlling these balances is often an ancillary benefit when a finance company considers a bank charter.

Fintechs and digital banking are disrupting banks’ core deposit business. Fintechs are pursuing deposit customers, in some cases encouraging traditional “depositors” to become “investors.” One prominent example is peer-to-peer lending. In another case, Varo Money transformed itself into Varo Bank and is aggressively marketing a free demand account with a debit card wherein the debit card interchange fees make the account profitable. Online account opening has enabled many banks to advertise, attract customers, open accounts, and grow deposits without branches or staff intervention. This business model fits the core competencies of many fintechs.

Regulatory Considerations

It is never easy for a non-bank to become a bank. From an approval perspective, bank regulators’ primary focus is typically on credit risk, then interest rate and liquidity risk, and finally operating risks. Evaluating your deal should address these risks in that order.

Credit risk, in particular, needs to be nailed down. First of all, banks face severe restrictions on loans to officers, directors and material shareholders (Reg O) as well as loans to affiliates (Reg W). These rules are tight enough that most banks simply avoid lending to employees (even overdrafts) and affiliates. To the extent that the deal takes advantage of lower borrowing cost (as noted above), the assets financed – typically loans now extended by the bank instead of through a non-bank – need to be credit-worthy. The bank’s credit policy must address the new class of assets by setting limits on borrower eligibility and concentrations.

Financial risks like interest rates and liquidity can usually be covered by setting and consistently meeting conservative policy limits.

Operational risk depends on whether the current practices and procedures are tightly controlled. Bank regulators’ requirements for a tightly controlled operating environment are, admittedly, a hurdle for most non- banks. Think of today’s bank vault as core systems and the IT infrastructure the security guard.

The business plan must address:

- Protocol and performance metrics used to manage risk with internal processes,

- Vendor management protocols,

- Disciplined change management and structured project management,

- Customer privacy protections and data sharing protocols,

- Risk assessments for new products, new operational practices, and new technology,

- Business continuity/operational resilience practices and testing thereof

- Information security, and

- Management and Board governance routines

Governance, policies and risk practices would also be critical. The governance plan must include the roles, responsibilities and management routines of the board of directors, its committees, senior management, and management committees. Lastly, compliance practices and financial crime programs would need to be robust, including Anti-Money Laundering/Know Your Customer (AML/KYC), Fair Lending, and many others.

Reg W – Transactions with Affiliates

Reg W limits transactions between a bank and its affiliates. Any company or individual within the same corporate family or under common control is deemed an affiliate. Restrictions include limits on:

- Lending: Capped at 10% of the bank’s capital

- Processing payments: Must be at the same service level and pricing as other customers

- Other transactions between a bank and its affiliates: Must be on fair market terms

White Paper - Affiliate Restrictions Considerations for Non-Banks Converting to, or Acquiring, a Bank

Conclusion

Evaluating the cost:benefit trade-off of becoming a bank is important for many non-banks. Endurance Advisory Partners addresses these topics proactively and will help you understand what a bank charter would require, what businesses fit into the bank, and would most certainly help design a bank acquisition plan which would achieve approval. Endurance is ideally positioned to assist non-banks with their acquisition search, negotiation, and execution. Our team has deep risk, operational, and IT expertise in banking and mortgage. We have dealt with these elements successfully in the past and are on a short list of those with direct experience with the complexities of non-bank conversions.

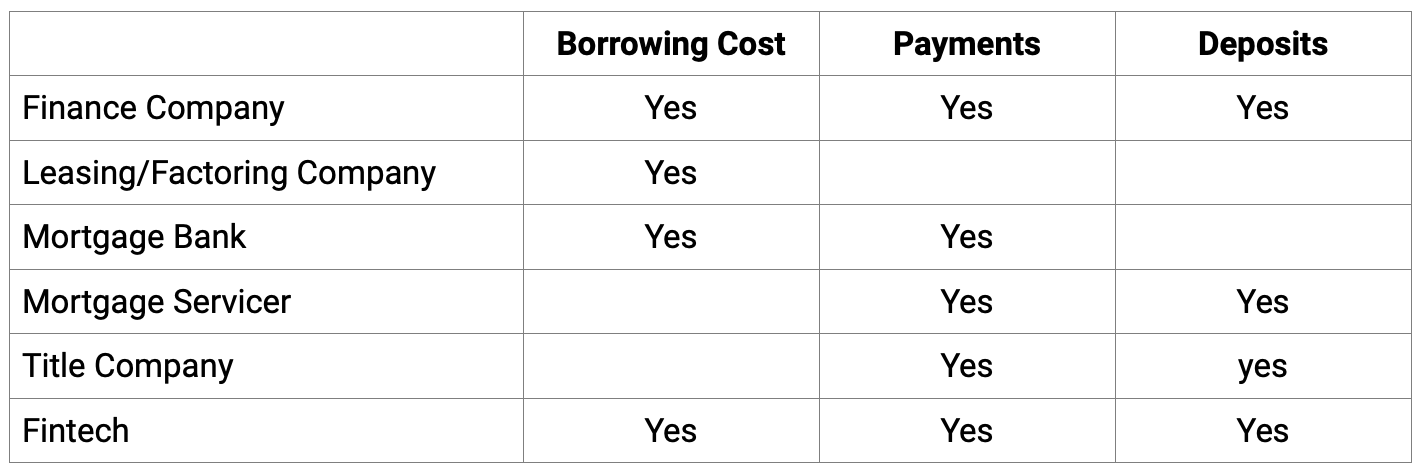

The following table highlights the key synergies available for each type of non-bank:

It is difficult and time-consuming for a non-bank to get into the banking business. Endurance has demonstrated success with private equity investors, family offices, and even a mortgage company being awarded approvals for bank mergers and acquisitions.

Disclaimer

This presentation is being furnished on a confidential basis to provide preliminary summary information. The information, tools and material (collectively, information) contained herein is not directed to or intended for distribution or use by any person or entity who is a citizen or resident of or located in any jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would subject Endurance Advisory Partners, LLC, to any registration or licensing requirement within such jurisdiction.

The information presented herein is provided for informational purposes only and is not to be used or considered as an offer to sell, or buy securities or other financial instruments, or any advice or recommendation with respect to such securities or other financial instruments. The information may not be reproduced in whole or in part or otherwise made available without the prior written consent of Endurance Advisory Partners, LLC. Information and opinions presented have been obtained or derived from sources believed to be reliable, but Endurance Advisory Partners, LLC makes no representation as to their accuracy or completeness. Endurance Advisory Partners, LLC, accepts no liability for any loss arising from the use of the information contained herein.

This information is subject to periodic update and revision. Materials should only be considered current as of the date of the initial publication, without regard to the date on which you may access the information. Endurance Advisory Partners, LLC, maintains the right to delete or modify the information without prior notice.

Under no circumstances and under no theory of law, tort, contract, strict liability or otherwise, shall Endurance Advisory Partners, LLC be liable to anyone for any damages resulting from access or use of, or inability to access or use, this information regardless of whether they are dire, indirect, special, incidental, or consequential damages of any character, including damages for trading losses or lost profits, or for any claim or demand by any third party, even if Endurance Advisory Partners, LLC knew or had reason to know of the possibility of such damages, claim or demand.