STORIES OF IMPACT

/

White Papers / IPO Process

IPO Process

Executive Summary

To IPO or not to IPO is a decision requiring careful consideration. This is the second installment in a three-part

series covering (i) the Pros and Cons of an IPO, (ii) the IPO Process and (iii) IPO Valuation.

The IPO market is hot again. Today’s flavor – mortgage and related businesses. Following Rocket/Quicken’s IPO, many are now considering it. Knowing this, investment bankers are moving quickly through the industry, seeking new and willing candidates.

Many companies enter discussions about an IPO only to abandon the effort part way. Before proceeding along this path, it is important for the Management and the Board to understand the full breadth of this undertaking.

Endurance believes that some of the mortgage banks seeking to follow Rocket/Quicken’s lead would be ill advised to do so. Endurance Advisory Partners has worked with financial institutions to develop the internal discipline necessary to become a public company. Below are thoughts regarding steps necessary to successfully execute an IPO.

IPO Process

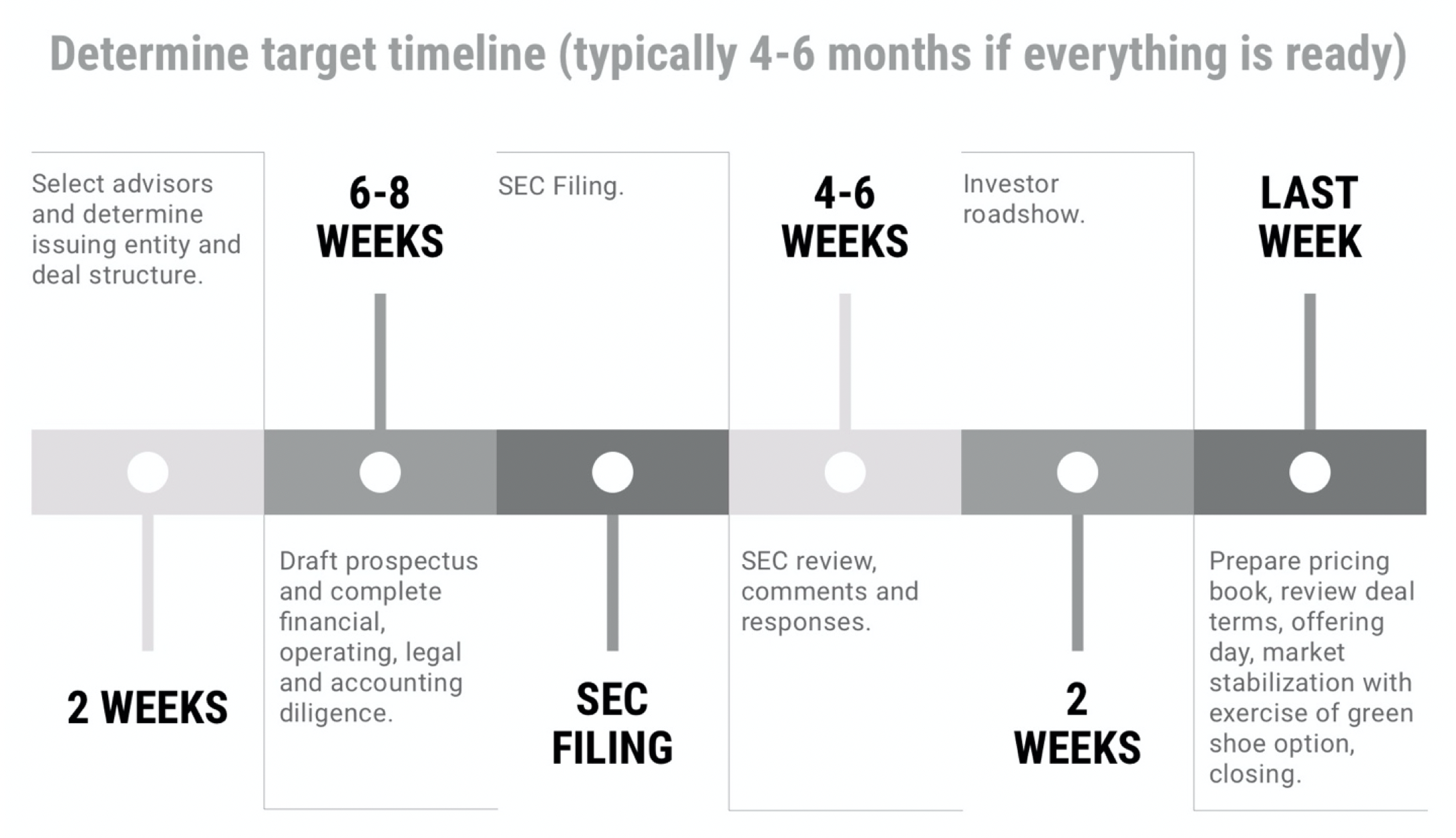

The IPO process is typically a 4-6 month journey – and that’s only if it already has the financial discipline in place that is required to describe its operations from a financial point of view. Before this process starts it is imperative that the Company undertake a careful review of the pros and cons to make sure that this is a journey worth taking.

Key Steps and Decisions

The following graphic shows the key steps to an IPO along with the time required for each. The timetable is neatly split in half by the SEC filing date – meaning half of the work happens before anyone outside of the company and its advisors knows what is going on. The process ends when the deal is priced and closes.

Pre-Filing

Most of the important decisions are made prior to the SEC filing. First of all, and most important, the Company must identify its key advisors: investment bank, legal, accounting, and tax. The investment bank will put together a “working group list” with contact information for everyone to expedite communication across the team. Together this team can answer the deal structuring questions and set a target timeline.

The IPO process is typically a 4-6 month journey – and that’s only if it already has the financial discipline in place that is required to describe its operations from a financial point of view. Before this process starts it is imperative that the Company undertake a careful review of the pros and cons to make sure that this is a journey worth taking.

The first question is: What entity should do the IPO? In some cases, the primary operating company is the best issuer because it’s closest to the business and has little “noise” that can complicate the story or detract from valuation. Other times it is best to use the holding company because, after all, existing shareholders probably invested at that level. It is surprisingly common for the best issuer to be an entity that doesn’t exist yet – an assortment of subsidiaries that have not been combined before.

Among banks, the correct choice is almost always the holding company. Issuing at the holding company enables the enterprise to manage leverage at the operating company (the bank) more easily and efficiently. That said, while it is rare, it is possible to execute an offering for shares of the regulated bank, particularly if there is no holding company. Similarly, it is possible for a mortgage bank to execute an offering of just the origination company or just the servicer. For example, Caliber is now both originator and servicer – formed when Lone Star combined separate origination and servicing investments in 2013. Caliber reorganized in preparation for an IPO and chose not to include the Lone Star entity that securitizes non-agency/government loans.

The next question is: Should the IPO be primary or secondary shares? With a primary share offering, proceeds go to the Company, whereas with secondary shares the proceeds go to the selling shareholder. Of course, it is possible to do a mixture of primary and secondary shares. Furthermore, it is possible to transform a secondary offering into a primary and vice versa through a series of bridge financings. Sophisticated investors see through such financings and understand that the Company can get to the same place by adjusting the mix of primary and secondary shares. That said, primary offerings are often favored because they signal that the Company is growing (use of proceeds is the next paragraph) rather than signaling that the existing holders think it’s a good time to sell.

A follow-on question is: What is the Company’s use of proceeds? Use of proceeds is always a critical consideration. Like any equity offering, the deal is first and foremost about raising capital, so the Company needs to have a need for that capital. The need for capital indicates that the Company has strong growth prospects.

The banking, accounting, legal and tax team needs to figure the deal structure out before getting started on the real “deal” process. Once the basic structuring questions are answered, the investment bank can seek approval from its Equity Commitment Committee. With that approval, the investment bank will work with the Company to pull together a Public Information Book of all of the marketing and financial information that is available. This information is typically uploaded to a virtual data room and shared with the entire working group. Now the team can start drafting registration documents. With structuring considerations resolved, the Company can move to the task of telling its story.

An IPO prospectus is a once-in-a-lifetime opportunity to tell the Company’s story to the public in a truthful and compelling way. Of course, the story is also told from a financial point of view. All marketing materials must rely on information, which is also disclosed in the prospectus; roadshow speeches are limited to prospectus disclosures. Hence, the Company needs to make the verbiage (and the numbers) compelling.

What are the most important operating statistics? The Company must figure out the optimal way to portray these operating statistics. For example, should tables group by product, channel or region? Combinations? Other? All operating statistics must foot to the financials. The Company needs to be in a position to provide audited financial statements for the issuer for the time period covered by the prospectus.

Getting the numbers right is hard; writing the text is harder. The text must simultaneously ring true to current shareholders and prospective investors. The Company should expect all executives to read it, and all employees will at least hear excerpts. The same is true of suppliers, vendors and other business partners. The prospectus is an opportunity to tell a new story, but at the same time the story must be consistent with what everyone already knows about the firm.

After going through innumerable drafts, the prospectus will finally be ready to file 6-8 weeks after starting the drafting sessions. During this process, the Company must select a printer (chosen once the prospectus has made it through the first several drafts). The Company will also choose a transfer agent and a registrar for its soon to be public stock. The Company’s board must formally appoint the transfer agent and registrar and then approve the form of the stock certificate and authorize enough shares to cover the offering. The board should also establish a “pricing committee” to expedite the approval of the offering price when the time comes.

Financial, operating and legal due diligence occurs simultaneously making these two months amongst the most difficult and exhilarating in the company’s history. Operating due diligence typically includes contact with suppliers and customers. Financial due diligence culminates with the investment bank and counsel discussing the Comfort Letters that the Company’s auditors must provide certifying the numbers in the prospectus. When the document is ready, it is sent to the printer where the final few drafts are reviewed. At this time, the investment bank returns to its Equity Commitment Committee to gain approval and its Equity Valuation Committee for the pricing range, if any, that will be included in the filing. The investment bank’s counsel will complete a preliminary Blue Sky survey to ensure that the offering complies with all state law. The Company’s public relations firm will prepare a press release about the filing. When the working group is fully satisfied, the prospectus is filed with the Securities and Exchange Commission (SEC).

Post-Filing

The SEC allows several weeks to review, make comments and turn comments. In total this typically takes 4-6 weeks (IPOs are almost never approved without review).

Look at other public companies to anticipate SEC (and investor) comments. What other companies are the best peers for the Company? For banks, this is relatively easy – banks are commonly grouped by size and region and, to a lesser extent, business. For Mortgage Banks, the choice of peers is more difficult. Prior to Rocket, there weren’t many (any?) well-respected public companies. Ocwen and Mr. Cooper are both public. Both have their blemishes. Add to that the recent history of Ditech. On the mortgage side there are also several REITs (Penny Mac and NewRes, but also Annaly, Two Harbors, Chimera, Cherry Hill). The REITs vary wildly in their operating activities. Some are clearly pure financial plays. Finally, banks with big mortgage operations like Flagstar can be considered.

The choice of comparables and the way that informs the Company’s presentation is critical. In fact, when Rocket Companies went public, it was hard to find any good comparables. The absence of comparables, which often translates into an absence of best practices or even a widely accepted methodology for valuing the stock, can result in low valuations or excessive volatility. One of the most consistent comments about Rocket was that investors did not know who to use as comparables. This was noted about Rocket in the months following its IPO:

“Ever since Rocket Cos. (NYSE:RKT) went public earlier this month, there has been debate over whether the nation’s largest home lender is really a fintech or more of a traditional consumer finance company.”

– Motley Fool

“One of 2020’s largest initial public offerings (IPOs), Rocket Mortgage (NYSE:RKT), formerly Quicken Loans, has also been one of the strangest. Shares in the mortgage originator have swung wildly from its $18 IPO price to almost $29 (and then back down again) as investors have second- guessed the value of RKT stock. It’s been a strangely wild ride for such a large company.”

– InvestorPlace

Anticipating SEC questions should prime the Company for answering investors’ due diligence questions. These questions range from general strategy to financial details. Of course, all of these answers must also be contained in the prospectus. At a minimum, the Company should be prepared to discuss:

- Overall Business Strategy

- Management (organization chart, experience, compensation, bonus program, contracts with

key employees, stock/option ownership)

- Market Strategy (competition, key producers, channels)

- Product Offerings and Differentiators

- Financial Diligence (balance sheets and income statements with discussion of any non- recurring items, copies of all financing agreements, copies of all shareholder agreements)

- Financial Planning (current plan vs actual, projections, critical assumptions/KPIs, historical data for all key performance indicators, tax status)

- Auditors (tax and accounting review)

Preparing the Roadshow Presentation consumes a lot of the post-filing time. The investment bank will work with the Company to write a presentation designed to capture the interest of prospective investors. If necessary, the investment bank will help the executive team by bringing in a presentation coach to ensure that the presentation will go well. When ready, they will do a dry run of the presentation. At this point in time, the investment bankers walk their equity research team through the Company’s story and financials; equity research, in turn, teaches the institutional salesforce the selling points for the stock. In short order, the bankers, research and salesforce are able to identify the target audience for the roadshow, and the bankers schedule the meetings.

The Roadshow can commence when the SEC is ready to declare the registration statement effective. Roadshows are designed to give potential institutional investors an opportunity to meet the management team and ask questions about the Company. Roadshow presentations are usually about an hour long and are followed by a question and answer period. In addition to group presentations, the investment banks will schedule many one-on-one meetings with potential significant investors. For one-on-ones, the roadshow presentation is usually abbreviated and the Q&A period extended. In most situations, allowing two weeks for the roadshow is adequate.

Pricing Day

After the roadshow, the investment bank prices the offering. Throughout the roadshow, the bankers keep track of expressions of interest by every potential investor. Most just specify volume, not price. As the roadshow concludes, they can review the entire book and allocate shares to each investor. If the book is strong, they can scale back shares committed to each investor, leaving more after-market demand. After the market closes, they will review deal terms with the Company and agree, so that it will be ready to open the following morning. Behind the scenes, the investment bank gains internal approval, coordinates with co-managers and underwriters, contacts the exchanges to release the trading symbol, and finalizes Blue Sky authorization, the Comfort Letter and other required documents.

When trading commences, the lead will control activity in the stock for up to a week of “market stabilization” to ensure a broad distribution of shares and strong market receptivity. They will also typically exercise a green shoe option, thereby increasing the size of the offering and covering their short position. At the end of a week, the deal is closed and the investment bank pays the Company the net proceeds of the offering.

Ongoing

The Company should be prepared to provide ongoing disclosure of the information in the prospectus. Since the prospectus is really the Company’s story, it should expect to continue adding to the storyline as each quarter passes. Once public, the Company will assume the standard disclosure obligations of a public company. These include:

- SEC filing requirements (10K and 10Qs with CEO/CFO certification plus annual proxy statement but also 8Ks reporting any material comments about the company or its performance – investor presentations, et al)

- Sarbanes-Oxley governance mandates must be implemented and audit completed

- Insider trading disclosures (note: insiders will be subject to trading windows or pre-planned

execution)

- Maintaining the listing requirements of the exchange

Summary

Our team at Endurance Advisory Partners can help. Endurance serves as an independent advisor who

will work alongside the Company to assist with IPO planning:

- Provide a detailed gap assessment of the Company, identifying key changes which need to be made to facilitate a successful IPO

- Assist with development of corporate strategy, risk management plan and key selling points for investors

- Provide support for dual-track strategies, such as private equity and other M&A transactions

- Assist with regulatory dialogue

- Provide analytical support to test and validate underwriter recommendations

- Develop a high-level timeline clearly identifying responsibilities

- Provide due diligence support for underwriters and key investors

- Help assemble the right IPO team – including prospective underwriters, accountants and key

employees

- Identify prospective independent directors to complement pre-IPO directors

- Work with the Company to model and right-size IPO and prospective follow-on offerings to

align a multi-year strategic plan and capital needs

Disclaimer

This presentation is being furnished on a confidential basis to provide preliminary summary information. The information, tools and material (collectively, information) contained herein is not directed to or intended for distribution or use by any person or entity who is a citizen or resident of or located in any jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would subject Endurance Advisory Partners, LLC, to any registration or licensing requirement within such jurisdiction.

The information presented herein is provided for informational purposes only and is not to be used or considered as an offer to sell, or buy securities or other financial instruments, or any advice or recommendation with respect to such securities or other financial instruments. The information may not be reproduced in whole or in part or otherwise made available without the prior written consent of Endurance Advisory Partners, LLC. Information and opinions presented have been obtained or derived from sources believed to be reliable, but Endurance Advisory Partners, LLC makes no representation as to their accuracy or completeness. Endurance Advisory Partners, LLC, accepts no liability for any loss arising from the use of the information contained herein.

This information is subject to periodic update and revision. Materials should only be considered current as of the date of the initial publication, without regard to the date on which you may access the information. Endurance Advisory Partners, LLC, maintains the right to delete or modify the information without prior notice.

Under no circumstances and under no theory of law, tort, contract, strict liability or otherwise, shall Endurance Advisory Partners, LLC be liable to anyone for any damages resulting from access or use of, or inability to access or use, this information regardless of whether they are dire, indirect, special, incidental, or consequential damages of any character, including damages for trading losses or lost profits, or for any claim or demand by any third party, even if Endurance Advisory Partners, LLC knew or had reason to know of the possibility of such damages, claim or demand.