STORIES OF IMPACT

/

White Papers / Syndicated Loan Market Opportunities

Syndicated Loan Market Opportunities

Executive Summary

Community and Regional Banks today, more than ever are experiencing aggressive competition for quality commercial loans. Competition is coming from all sides and not just in market competitors but from global banks, finance companies, business development corporations and direct lenders. Many banks have become increasingly liquid given the additional $2 trillion in deposits that has found its way into the banking system post the Federal Reserve’s actions beginning in March of this year. Putting deposits to work in municipal bonds and treasuries while accretive will not correlate into significant increases in interest margin.

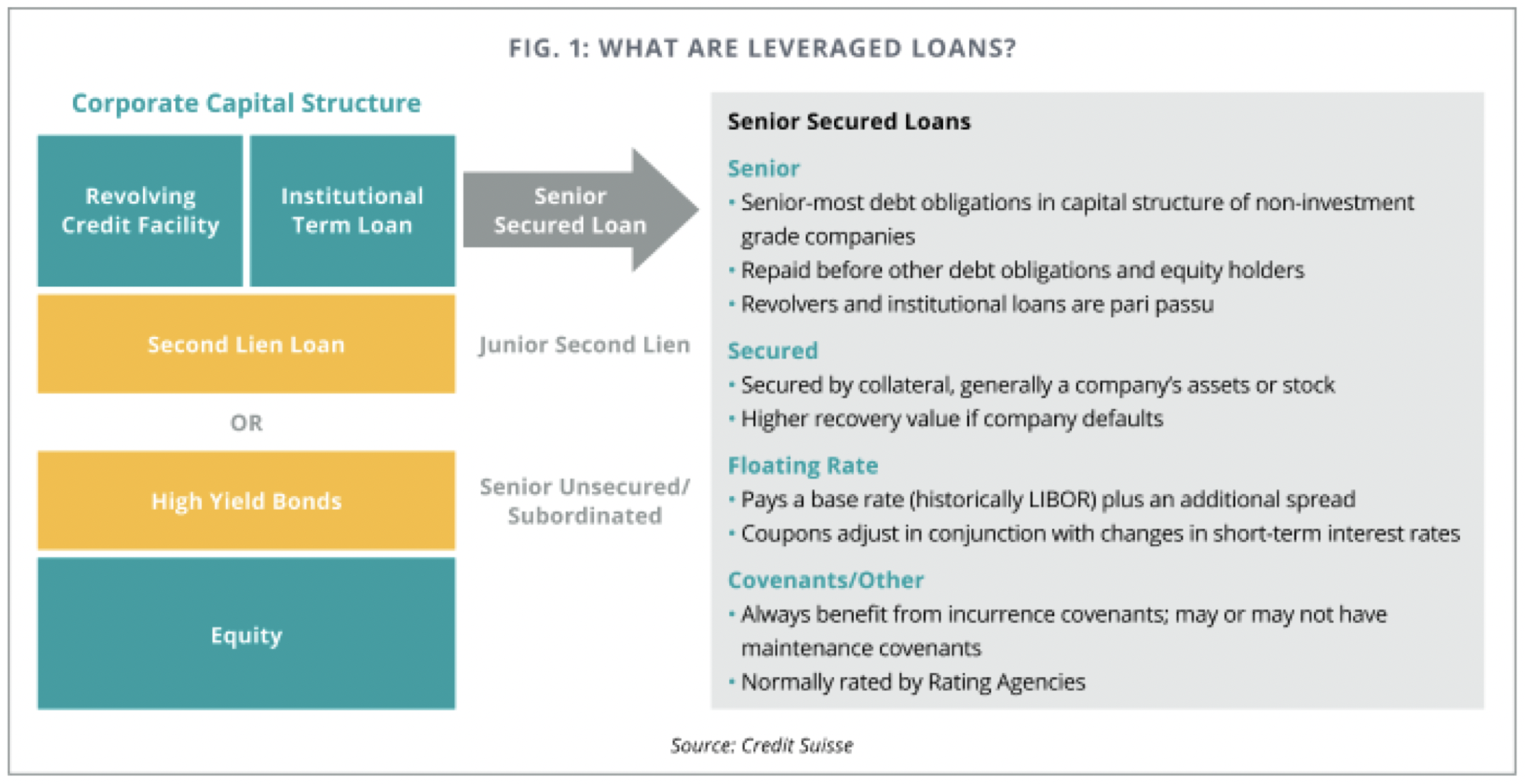

Purchasing Loans in the Secondary Syndicated Loan Market can be a meaningful source of funded senior secured term loans. For the most part commercial loans in the Secondary Market consist of Leveraged Loans, i.e. loans to companies that are rated non-investment grade, BB+ and Ba1 or lower by Standard & Poor’s and Moody’s Investors Service, respectively. Leveraged Loans are originated when corporations and private equity firms utilize funded floating rate senior secured debt to acquire businesses, recapitalize and execute large stock repurchase programs.

Why Pursue Syndicated Loans in the Secondary Market

- Increase commercial and industrial loan balances

- Increase net interest income

- Add a tool for cost effective loan origination and maintenance away from relationship manager platforms

- Add efficiency in managing loan balances

- Assist in adding industry diversification with access to industries which may be less prevalent in-footprint

- Diversify geographic risk. Many large corporate borrowers have national and/or global operations

Leveraged Loan Characteristics

Leveraged loans are positioned at the top of the capital structure, are first in line for debt repayment and are typically secured with a first priority lien on nearly all of the assets of the borrower. Senior secured leveraged loans can consist of multiple components and tranches including a revolving credit facility and term loans. The revolving credit facility is only held by banks. Term loans normally make up the borrower’s remaining funded senior secured debt. Term loans are often further bifurcated into what is commonly referred to as Term Loan A and Term Loan B tranches. Term loans are held by banks and institutional investors.

Term Loan A tranches are sized along with the revolving credit facility to be placed with banks and not exceed bank market capacity. Term Loan A tranches are sized and structured to meet bank underwriting criteria with tenors of 5 years, reasonable principal amortization including excess cash flow recapture, repayment provisions (based upon risk profile) and contain financial covenants.

Term Loan B tranches are longer dated at or around 7 years in maturity and have nominal annual amortization of as little as 1% of principal. Most Term Loan B tranches do not have financial covenants but have cross defaults to the Revolving Credit facility and Term Loan A tranche. Term Loan B tranches are sized and structured to meet market appetite of institutional investors including mutual funds, commercial loan obligation managers (commonly referred to as CLOs), insurance companies and hedge funds. Because of the investor type, these are commonly referred to as Institutional Term Loans. Banks can invest in Term Loan B tranches in the secondary market.

Revolving Credit and Term Loan A facilities normally have performance pricing grids which dictate applicable margins and unused commitment fees tied to metrics such as Debt to EBITDA or debt ratings. Term Loan B margins are set higher at funding than Term Loan A tranches reflecting extended maturities, lack of covenants or covenant lite accommodations, and nominal contractual principal repayment. Term Loan B tranches may or may not have performance pricing grids.

Pricing available to purchasers is driven by the market. Factors that drive the “Bid Ask” or “Offer” include overall market dynamics as well as credit outlook for the borrower. All loans are sold as assignments and not participations. Sellers do not “scrape” interest margin. Loans are sold below, above or at par.

It is important to note that Revolving Credit and Term Loan A loan banks receive up-front fees at closing while Term Loan B tranches are issued with an OID or original issues discount similar to a bond. Fees and discount have the same impact on net yield.

Revolving Credit and Term Loan A facilities are prepayable at par. In most instances Term Loan B tranches have prepayment fee provisions in years 1 and 2 meeting the market expectations of the prospective investor base.

Leveraged Loans can often be $1 billion in size or more and can be surprisingly transparent. The Rating Agencies including Standard & Poor’s and Moody’s Investors Service rate individual loans which is an expectation of the Institutional Loan investor base. Secondary market prices of loans are provided by two services (IHS Markit and LSTA/Refinitiv LPC Mark-to- Market Pricing). These services provide daily marks on more than 2,800 individual loan tranches. Importantly, there is roughly $700 billion of loan trading each year, so these prices are tied to real transactions. In short, there is considerable information available on individual loans.

Leveraged loans have performed well in the last 20-plus years, including during the worst financial crisis since the Great Depression. The average historical default rate on leveraged loans is 2.9%, according to S&P/LCD. Of course, the default rate waxes and wanes based on the credit cycle and did briefly climb into the 10% range during the financial crisis. But it is important to recall that leveraged loans are senior and secured and sit at the top of companies’ capital structures, and they are first in line to be repaid in the event of a default; Revolving Credit, Term Loan A and Term Loan B facilities are pari passu.

Market Size: $1.2 Trillion and Counting

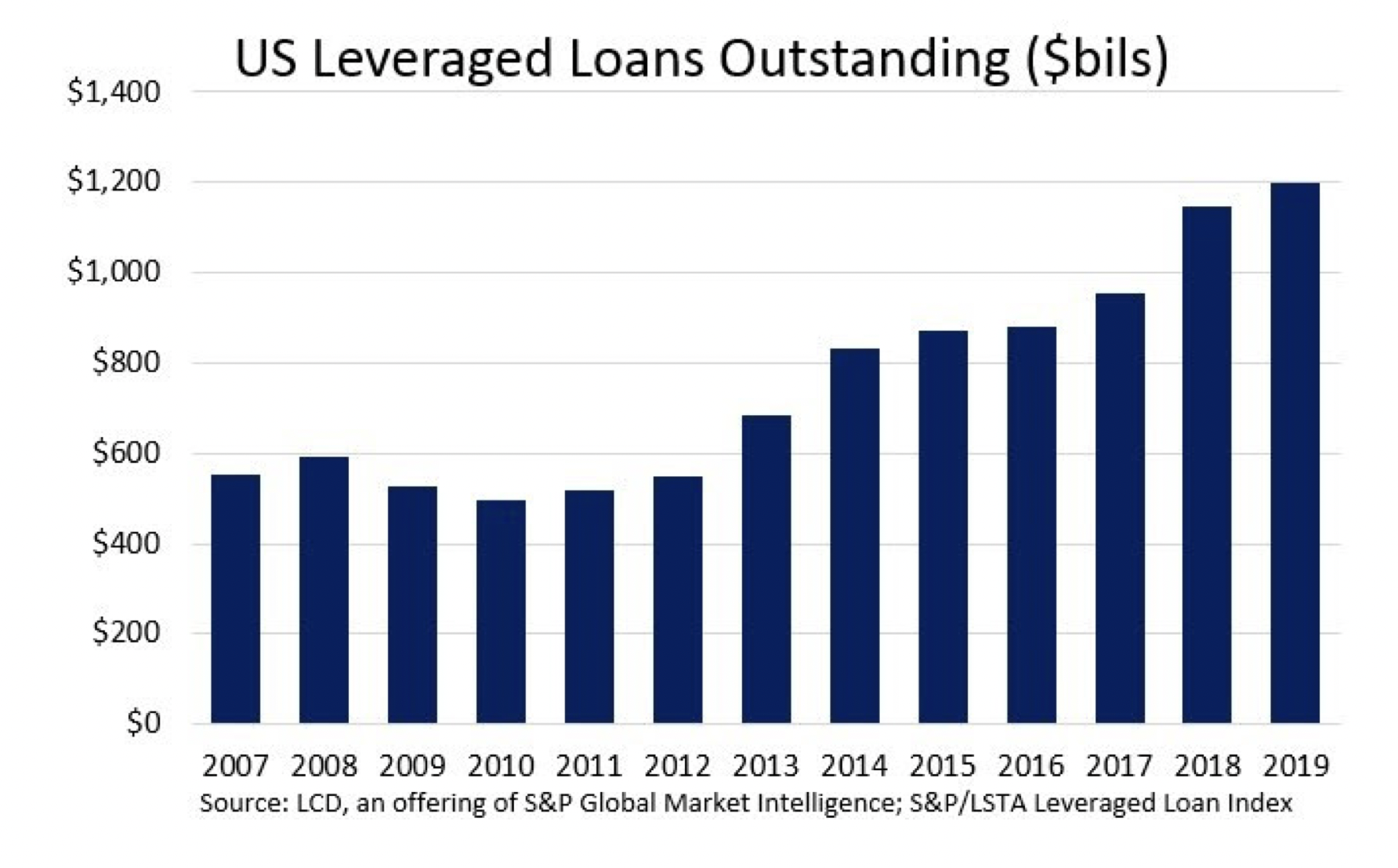

The Global Leveraged Loan Market has grown consistently since its humble beginnings, some decades ago, to become a full-fledged asset class and an indispensable component of the corporate finance, M&A, and leveraged buyout landscape.

Indeed, the S&P/LSTA Loan Index, broadly used as a proxy for market size in the U.S., totaled nearly $1.2 trillion at year- end 2019, the most ever, after growing every year since it dipped to $497 billion in 2010, when the market was still licking wounds incurred in the financial crisis of 2007/08.

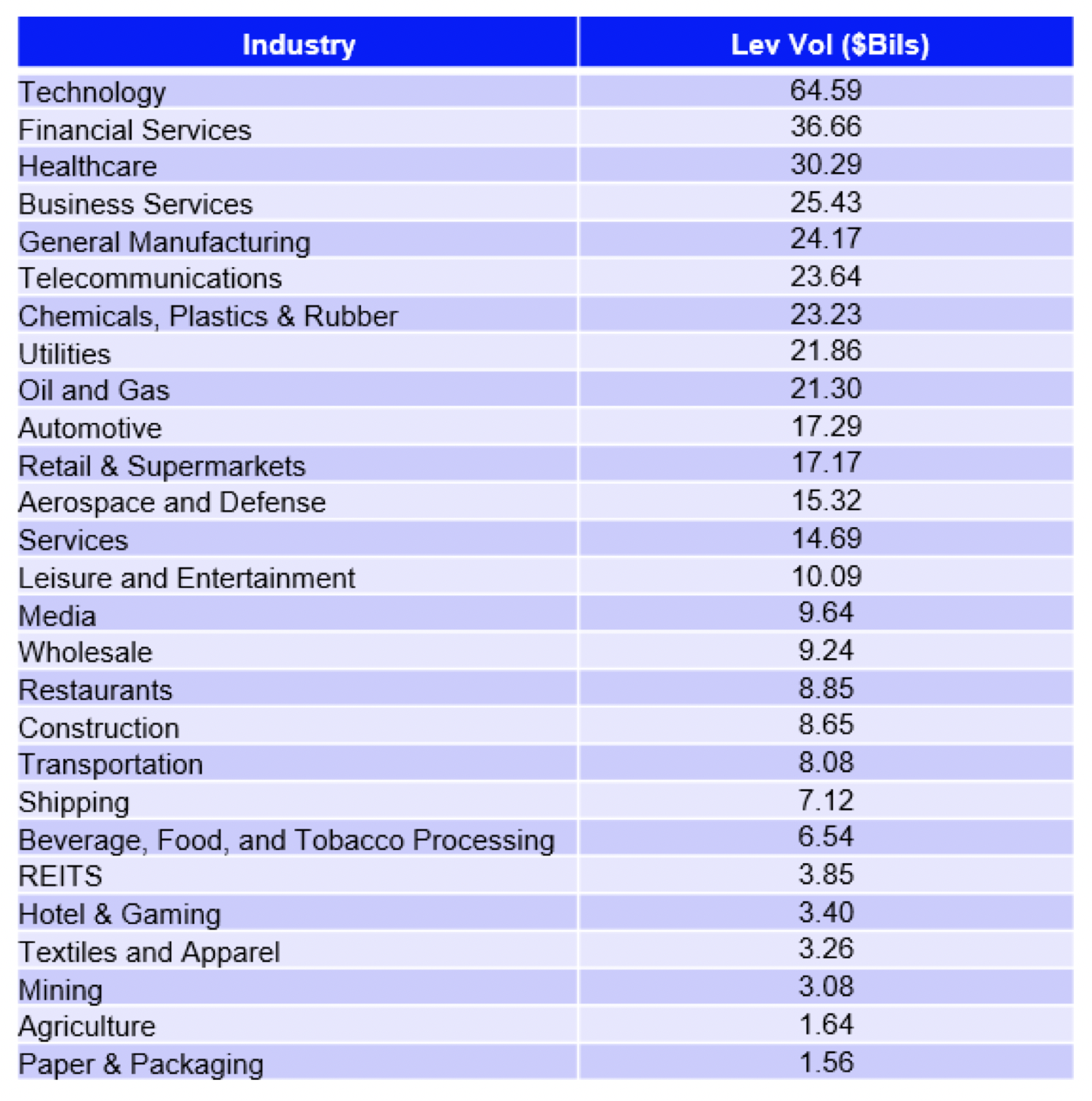

2020 YTD Leveraged Loan Issuance by Industry

Leveraged Loans cover a cross-section of industries as shown in the following table. Technology, Financial Services and Healthcare are the leading sectors but are not dominant. Banks and other investors can target specific industries to diversify or exclude certain sectors to avoid undue concentrations without materially limiting their selection.

Institutional Loan Investors

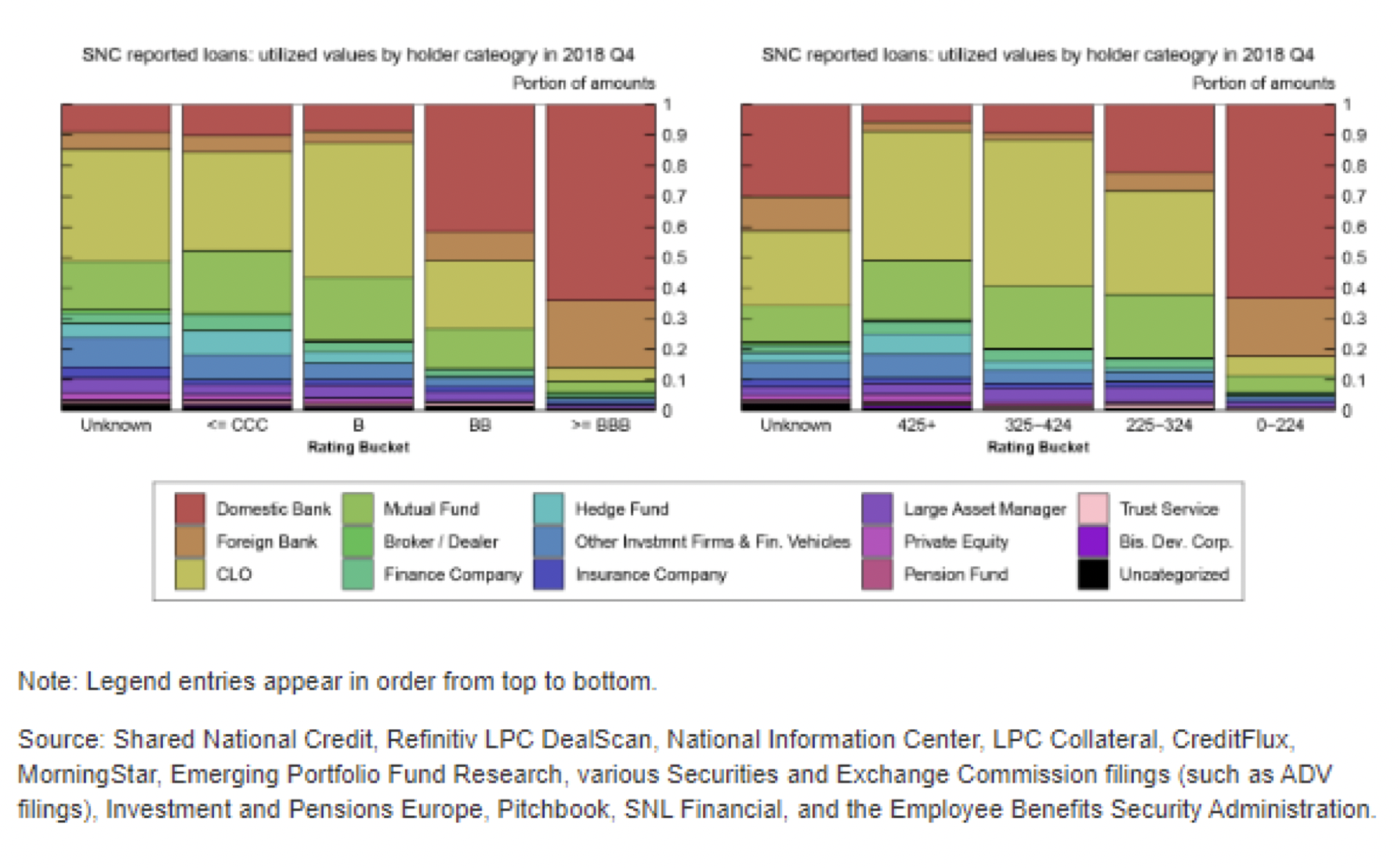

Collateralized Loan Obligations (“CLOs”) are the single largest holder of Institutional Loans, with an approximately 51% market share. CLOs are a stabilizing factor in the loan market. Like banks, the CLO manager assesses credit risk of potential borrowers according to an established set of criteria and an established process. CLOs issue long-term liabilities in the form of floating rate notes and use the proceeds to invest in, among other things, senior secured commercial loans.

Separately Managed Accounts, High Yield Funds and Hedge Funds account for approximately 38% market share, with the remaining 11% share comprised of Loan Mutual Funds and other investors. Banks are grouped with other investors.

Important Considerations for Banks

- While Term Loan B tranches are similar to standard commercial loans your bank may be originating, there are some important distinctions regarding loans offered in the Secondary Market. For example original maturities of Term Loan B tranches typically exceed 5 years. However, it is important to note that secondary market purchases of Term Loan B tranches can be made with maturities of less than 5 years in many instances.

- Most Institutional Investors self-declare as Public Investors vs. Private Side Investors. By doing so Non Public Information including financial projections are not made available to holders of Term Loan B tranches. That said, as a private side investor, a bank holder of Term Loan B tranche often (but not always) has access to the same information (e.g. financial projections) as Revolving Credit or Term Loan A holders.

- Leveraged loans should be underwritten on cash flow as opposed to hard asset valuation. Enterprise value as well as borrower’s historic and prospective access to the capital markets should also be taken into consideration.

- Term Loan B tranches may have lower amortization and may lack financial covenants. However, these are cross defaulted and cross collateralized to the Revolving Credit and Term Loan A facilities

- Banks may need to augment their credit policies as well as underwriting and portfolio management policies and procedures.

- Credit approvals must be completed prior to any loans being purchased. Sellers will not “hold” paper or guarantee pricing subject to credit approval.

- Ancillary cross sell business from the borrower is not available.

Process/Timeline

Prospective secondary buyers have access to public-side Lender Presentations as well as all other documentation provided to lenders/investors in primary transactions. Once bank credit approval is obtained, an available loan seller is identified, and a trade has been executed settlement typically takes between 3 and 14 days.

The Secondary Trading Market has been standardized by the Loan Syndications & Trading Association (“LSTA”). Documents include:

- Secondary Trading Master Confidentiality Agreement

- Trade Confirmation

- Assignment & Assumption Agreement

- Funding Memo

The Administrative Agent for the Senior Secured Credit Facilities coordinates the settlement process of the secondary transaction. Shortly after receipt of the executed Trade Confirmation and Assignment & Assumption Agreement and any other necessary borrower or Administrative Agent approvals are obtained, the Administrative Agent will execute the documentation, formally recognizing the Buyer as a Lender of Record. The typical timeline for a secondary market investment is:

Week 1:

- Identify opportunities that fit your bank’s risk appetite

- If required enter into a Secondary Market Master Confidentiality Agreement or non-

disclosure agreement

- Perform credit analysis and all due diligence for presentation to Credit Committee

Week 2-3:

- Obtain Credit Approval

- Source available loans in the Secondary Market

- Execute trade and receive Trade Confirmation

Week 3:

- Execute Assignment & Assumption Agreement

- Draft Funding Memo Received

- Assignment Received, Lender of Record, Funds Wire

Transactions costs for this investment are established in each credit agreement. Normally the Administrative Agent is allowed to charge the Seller and Buyer an Assignment Fee (usually $3,500). Certain situations may result in the fee to be split between Buyer and Seller or, when trading with the Administrative Agent, the fee may be waived.

Regulatory Guidance

While loans purchased in the secondary market have some “Wall Street” attributes, it is important to note that they are first and foremost loans – not securities. As a result, it is critical for the investing bank to perform all of the due diligence and credit approvals it would require prior to extending credit to any similarly situated borrower. Such credit approvals typically include a Loan Approval Worksheet/Memo followed by credit approval as specified in the bank’s loan approval authority grid.

Prior to investing in Term Loan B tranches or other syndicated loans, most banks establish a policy which details the board’s risk appetite for concentrations of loans in this segment. In most cases, the policy will specify an aggregate concentration limit (either a percent of total capital or a percent of the portfolio). The policy may also specify other limits on loans in this segment such as restrictions on lending in certain industries/geographies or, conversely, targets for lending in certain industries/geographies. A bank’s policy often explains the benefits it expects to achieve by investing in these loans. These benefits often include:

- Liquidity

- High recovery in the event of default

- Geographic and/or industry diversification

- Access to market valuations

Ordinary loan trading relationships in the loan market do not create a formal “account” or banking relationship between the parties. Therefore, Customer Identification Program (“CIP”) procedures are not required.

From a regulatory perspective, all loans from three or more banks to one borrower that exceed $100 million are known as Shared National Credits (“SNCs”). Bank regulators review all SNCs at the agent bank and those loan ratings are used by all of the other banks participating in the syndication. All broadly syndicated loans, including Term Loan B tranches, qualify as SNCs and must be reported as such.

Call Us. We Can Help

Call us anytime to discuss how to build your loan book and better manage risk through syndicated finance and loan sales and participations.

Joe Siegel

Managing Director

jsiegel@enduranceadvisory.com

Cell: 469-236-5042

LinkedIn Profile

Todd Helman

Director

thelman@enduranceadvisory.com

Cell: 301-379-5777

LinkedIn Profile

Disclaimer

This presentation is being furnished on a confidential basis to provide preliminary summary information. The information, tools and material (collectively, information) contained herein is not directed to or intended for distribution or use by any person or entity who is a citizen or resident of or located in any jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would subject Endurance Advisory Partners, LLC, to any registration or licensing requirement within such jurisdiction.

The information presented herein is provided for informational purposes only and is not to be used or considered as an offer to sell, or buy securities or other financial instruments, or any advice or recommendation with respect to such securities or other financial instruments. The information may not be reproduced in whole or in part or otherwise made available without the prior written consent of Endurance Advisory Partners, LLC. Information and opinions presented have been obtained or derived from sources believed to be reliable, but Endurance Advisory Partners, LLC makes no representation as to their accuracy or completeness. Endurance Advisory Partners, LLC, accepts no liability for any loss arising from the use of the information contained herein.

This information is subject to periodic update and revision. Materials should only be considered current as of the date of the initial publication, without regard to the date on which you may access the information. Endurance Advisory Partners, LLC, maintains the right to delete or modify the information without prior notice.

Under no circumstances and under no theory of law, tort, contract, strict liability or otherwise, shall Endurance Advisory Partners, LLC be liable to anyone for any damages resulting from access or use of, or inability to access or use, this information regardless of whether they are dire, indirect, special, incidental, or consequential damages of any character, including damages for trading losses or lost profits, or for any claim or demand by any third party, even if Endurance Advisory Partners, LLC knew or had reason to know of the possibility of such damages, claim or demand.